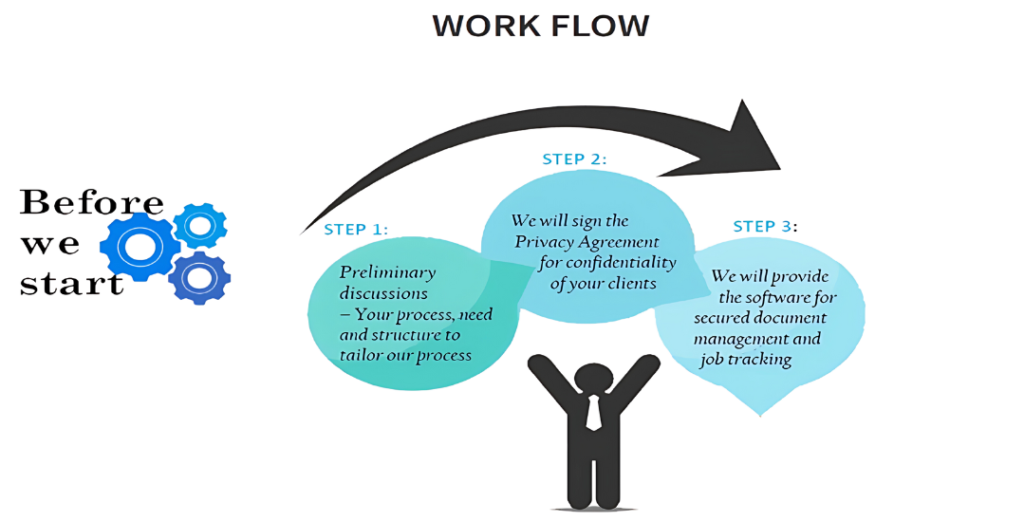

How we Work

How we process

Send us your job- Upload documents to our DMS or your remote server.

VPO will review and budget the estimated time required for job and send to you for approval

Upon approval of the budget, we will start preparing the file advising any queries or missing information.

If necessary, your team obtains further information from relevant client.

Work is completed, reviewed by senior accountant and sent to VPO directors for high level review. When approved, outputs are sent to your team for approval.

Your team reviews the work. Revisions or adjustments can be requested by email.

Final output with software backups, workpapers, checklists, supporting documentation will be sent to your team and you can advise the job is complete.

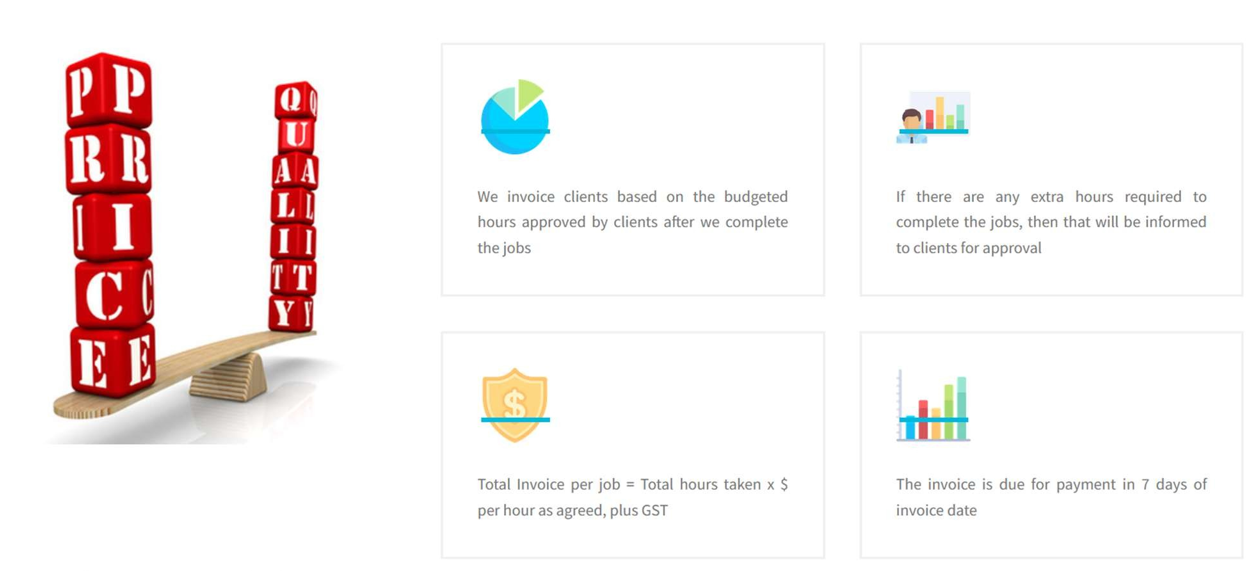

Pricing

Our pricing strategy is designed to be transparent and flexible, ensuring you get the best value for your investment. We provide customized pricing options that are fair, competitive, and aligned with the scope of your needs, all while maintaining the highest standards of quality

Work Procedures

BOOK KEEPING and BASes

You should provide access to bookkeeping software by sending an invitation from your bookkeeping software to our email id.

- All the source document for the relevant period (Quarter/Month) should be uploaded in BOX (a document management software) such as bank statements, Credit Card Statements, Sales Invoices, Suppliers Bills.

- Automated Bank Feed can be activated for the bank accounts and Credit Card account for entering the Bank Transactions in the If the Automation Bank Feed is not updated, you can provide us a csv file for bank transactions, so that we can upload the transactions in the software.

- We will process the transactions, record revenue and expenses, record wages, salaries and super and prepare reconciliation of Bank Accounts and Credit card accounts.

- Jobs processed by the Accountants will be reviewed by the Senior Accountants and we will send a Management Report.

- After finalization of Bookkeeping BAS work papers and BAS return will be prepared in Handi tax and send it to you.

- We also help in tax planning for the employees and to ascertain the PAYGW to be made at the beginning of the Financial Year.

TRUST AND PARTNERSHIP FINALIZATION

Upload the Source document such as previous year Financial, Previous year Tax Return, Handi Tax and Handi Ledger Backup, Previous year working papers, Current year Source documents, ATO Portol Reports, Bookkeeping software backup if the records are not maintained in the cloud based platform.

- We will send you estimated budgeted time with probable completion

- Once budget is approved, we will process the job and send you the list of

- Once you reply the queries, we will finalize the job which will be internally reviewed by

- Once the job is reviewed we will send the job to you which includes as below:

- Tax Return

- Financial Statements

- Work papers for all the balance sheet line item

- Work paper for wages and salaries, superannuation, accounting fees and for those line item which has material variation as compared to previous year.

- Trust minutes for the distribution of trust profit among the

- We propose to distribute the profit of the trust to the beneficiary in the most Tax Effective manner.

- We use Hownow work papers which is a Macro Enabled excel based Work papers.

Company finalization

Upload the Source document such as previous year Financial, Previous year Tax Return, Handi Tax and Handi Ledger Backup, Xero finalized or QBO finalized prior year data, Previous year working papers, Current year Source documents,

ATO Portol Reports, Bookkeeping software backup if the records are not maintained in the cloud based platform.

- We will send you estimated budgeted time with probable completion

- Once budget is approved, we will process the job and send you the list of

- Once you reply the queries, we will finalize the job which will be internally reviewed by

- Once the job is reviewed we will send the job to you which includes as below:

- Tax Return

- Financial Statements

- Work papers for all the balance sheet line item

- Work paper for wages and salaries, superannuation, accounting fees and for those line item which has material variation as compared to previous year.

Division 7A treatment

If the company has loan to the directors, then the company should ensure to make minimum repayment as per the Division 7A of Income tax Act. If wages are to be paid to the director at the year end after finalization of books of accounts, we propose to make the Division 7A minimum repayment to be adjusted against this wages If divided is to be distributed, the Division 7A minimum repayment to be adjusted against the dividend.

Individual Tax Returns

- Upload the source document for processing returns. Source document shall include PAYG summary, interest summary, dividend statements, ESS statements, ETO, Lump sum payments summary, ATO prefill, MV deduction details, laundry, self education expenses details, work related deduction details, donations, tax agent fees, eligible super contributions, income protection, interest on equity loan, business details in case of sole trader, trust and partnership distributions, managed funds, capital gains, agent summary in case of rental, out of pocket expenses, interest on borrowings, crypto trading statements and so on.

- We will send you estimated budgeted time with probable completion

- Once budget is approved, we will process the job and send you the list of

- Once you reply the queries, we will finalize the job which will be internally reviewed by

- Once the job is reviewed we will send the job to you which includes as below:

- Tax Return

- Workpapers for all income and deduction

PAYROLL AND STP FINALIZATION

- Upload the attendance details, work hours, hourly rate of each Any salary sacrifice must be informed in advance.

- We will run payroll by inputting the data on a weekly, fortnightly or monthly

- PAYG adjustments and super adjustments will be made if

- Payrun will be finalized and submitted to ATO as well as a part of STP